County Assessor Candidates Clash Over Campaign Cash, Assessment Data, and Tax Fairness at West Side Forum

The event at Collins High in North Lawndale highlighted sharp divides between incumbent Fritz Kaegi and his Democratic challenger Pat Hynes over ethics rules and how to fix an inequitable property tax system

A Feb. 11 candidates forum at Collins High School, 1313 S. Sacramento Dr. in North Lawndale, laid bare some of the central dividing lines shaping the race for Cook County assessor, mainly where the candidates are getting their money and contrasting proposals for correcting the inequitable property tax system. The Culture cosponsored the forum alongside the Westside Branch NAACP and other community organizations. You can watch it in full on the Westside Branch NAACP’s Facebook page.

Incumbent Democrat Fritz Kaegi, Democratic challenger Pat Hynes, and Libertarian candidate Nico Tsatsoulis debated issues ranging from regressive tax burdens in Black neighborhoods to the role of property tax appeal lawyers, but campaign finance and political alliances hovered over the hour-long exchange.

The Cook County assessor’s office determines the market value of roughly 1.8 million parcels, which shapes each property owner’s share of the tax burden, a process that has drawn intense scrutiny as residential bills have climbed fastest in many South and West Side neighborhoods.

Money has become one of the clearest contrasts between the candidates.

Kaegi has raised more than $2.5 million for his campaign, compared with just over $1 million raised by Hynes, according to recent reporting and campaign finance filings.

Much of Kaegi’s fundraising advantage comes from his own wealth and individual donors rather than industry groups. Hynes, by contrast, has built a coalition fueled by labor organizations, real estate professionals, and property tax industry figures — a dynamic that has turned campaign finance into a defining issue in the race.

According to reporting by the Chicago Tribune, Hynes has accepted nearly $90,000 from property tax law firms and attorneys and roughly $13,000 from property tax appraisers since June. Kaegi has repeatedly framed those contributions as a return to the “pay-to-play” culture he ran against in 2018, saying the county inspector general previously warned such donations posed ethical risks.

Kaegi touted an ethics order barring his office from accepting donations from attorneys who handle appeals, saying the practice once fueled inequities that favored large commercial properties over homeowners.

Hynes countered that the real problem is inaccurate data and unpredictable assessments, arguing that better information about property conditions and sales would reduce the need for appeals altogether. According to Tribune reporting, he’s dismissed the criticism about his donations as political spin, arguing that attorneys risk more by backing a challenger than an incumbent.

Public filings show little comparable campaign-finance activity from Tsatsoulis, reflecting the Libertarian candidate’s smaller campaign operation. Tsatsoulis said the inflated assessments generate business for lawyers.

Labor and political endorsements reshape the field

Endorsements have further clarified the candidates’ bases of support.

Hynes has secured backing from several major labor organizations — including electricians and building trades groups — and has appeared alongside union leaders at campaign events, including a rally at IBEW Local 134. He has also won support from a coalition of Black clergy and South and West Side elected officials, with Ald. Jason Ervin (28th) pledging to help mobilize voters in West Side communities.

Hynes told the Tribune that sharp assessment increases were a “breaking point” for many elected officials, arguing that rising bills are forcing residents out of their homes.

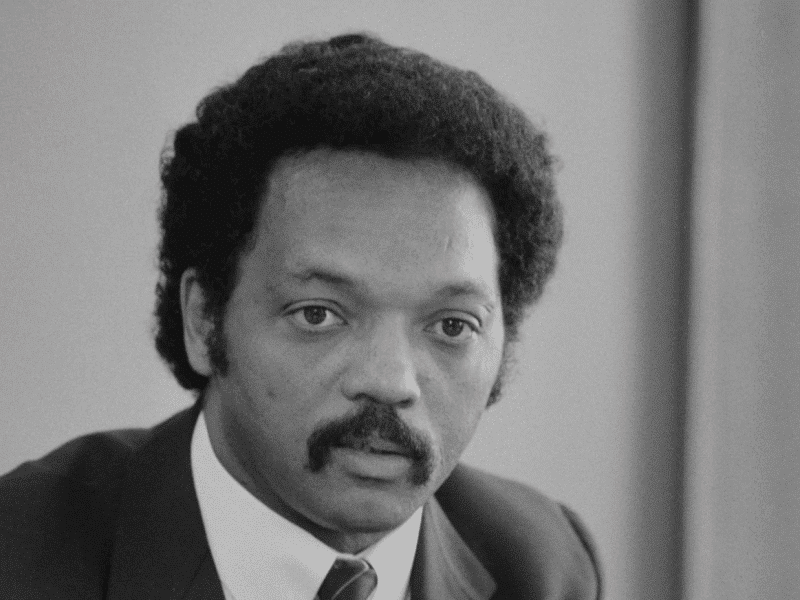

Kaegi, meanwhile, has assembled a different political coalition, emphasizing endorsements from prominent Black elected leaders and progressive allies. His campaign highlights support from U.S. Reps. Danny Davis, Robin Kelly, and Jonathan Jackson, along with Chicago alderpersons Maria Hadden, Anthony Beale, and Chris Taliaferro, among others.

The incumbent’s campaign has also leaned heavily on its outreach record, noting that the assessor’s office held over 240 community outreach events and processed 1.5 million homeowner exemptions last year, an effort Kaegi argues demonstrates a focus on protecting residents in historically overtaxed neighborhoods.

Competing visions for fixing regressive taxes

Despite broad agreement that Cook County’s tax system often disadvantages lower-value homes, the candidates offered sharply different solutions.

Kaegi emphasized structural reforms, including improving commercial property assessments and pushing for a state “circuit breaker” program to limit tax increases.

Hynes argued the county’s data is fundamentally flawed, calling for more accurate parcel information and consistent valuation methods.

Tsatsoulis advocated a smaller-government approach, proposing caps on property taxes and assessments based strictly on recent market sales.

The debate highlighted a deeper political question for voters, particularly on the South and West sides, where rising tax bills have become a defining issue.

Kaegi is asking voters to continue a reform agenda centered on ethics rules, new data models, and outreach to historically underserved homeowners.

Hynes is positioning himself as an experienced insider backed by labor, clergy, and local elected officials who say the system has reached a breaking point.